Debunking the family office “trend” landscape

Why focusing on enduring issues can lead to better outcomes for families

There are a lot of articles (typically released annually in January) that discuss trends in the family office space. We’ve all seen them. Frequently, we encounter a catch-all list of predictable family office topics, such as "the impending massive you-better-not-miss-this generational wealth transfer event is coming now." Occasionally, someone will share a topic-specific trend listicle that is both useful and interesting.

The notion of a precise accounting of family office trends can be alluring.

But where to find that data? How can we find information with sufficient analytical rigor for drawing practical, generalizable conclusions?

Searching for family office trends

One source of information on family office trends is survey data.

Family office surveys are not new, but the quality of the analysis can sometimes be lacking. Some family office surveys lack proper question design and sampling techniques (e.g., sampling just their own set of clients instead of a broader family office population). Family office surveys can also suffer from response biases, selection errors, question order bias, etc. We also observe instances of overgeneralization of family office population set results (e.g., 41% of family offices engage in "X" or invest in "Y"). This leads to potential errors in results because the data doesn’t compare different levels of net worth, locations, years of existence, family size, and investment experience, among other factors. In addition, families can view this general analysis and conclude, "Well, that does not apply to our family office."

These inherent design and analysis flaws can lead to interesting (albeit directional) insights about the family office world. It can also be hard to extrapolate the findings to the entire population of family offices. Moreover, family office survey flaws make comparing family office survey results between studies difficult or pointless.

Nonetheless, some organizations have invested in the talent and resources necessary to conduct periodic surveys on comparable topics. These analyses generate useful longitudinal data and benchmarks for family offices regarding crucial topics such as compensation and human capital.

How do we tell what is important for family offices from what is trending globally?

How can we distinguish between “top of mind” for family offices versus “top of sales funnel” for vendors?

Proposing trends when we can’t agree on a definition of a family office

Many in the family office arena agree that there is a distinction between a single family office (SFO) and a multi-family office (MFO), but beyond these distinctions, the situation becomes murky. Nonetheless, there appears to be disagreement even on this fundamental distinction with concepts such as the multi-single family office (MSFO). Adding the terms "family enterprise" and "true family office" to the mix makes industry jargon even more confusing for families and their external advisors and internal staff.

A topic for separate discussion, but it is worth exploring the idea that there is no such thing as a “family office”. Family offices are not things, hurdles of net worth, or lists of tasks.

Family office is a methodology and mindset.

Perhaps Family office as a service (FOaaS) is a more accurate description. In any case, if we "family office" effectively, families will achieve what they/we all desire: a higher quality of life.

If family office “trends” are problematic, perhaps looking at more persistent issues that family offices face could be a useful exercise.

Family office is a methodology and mindset.

What are the enduring issues that family offices face?

When it comes to enduring family office issues, there are two (of many) perspectives we can consider: the staff of the family office organization and the family members they serve.

The following is a sample list of perennial issues that arise in conversations with family offices, regardless of their net worth, location, number of employees, etc. Not all of them apply simultaneously, some family offices will disagree with these notions entirely, and some of them can be irrelevant to certain family offices, but the issues provide examples of constant-of-mind matters for family offices:

-

Frustration with narrow-scope solutions from the advisory/vendor market (no one brings it all together)

-

Belief that they "do not own" a large quantity of their personal and business data

-

Uncertainty if they are “on track” with operations, assets, personal issues, and business matters

-

Skepticism toward outsiders

-

Failure to build strategic planning process that includes: a comprehensive strategy, projects and standards to achieve strategic goals, key performance/risk indicators (KPRIs), and feedback loops for course corrections

-

Interest in relevant legal and regulatory issues both now and in the future

-

Demand of privacy and safety (and hyper-speed execution of services)

-

Preference of individualized service delivery

-

Struggle with identifying and retaining high-value employees

-

Siloing of information and operations among staff and other stakeholders

-

Conviction that no comprehensive family office technology exists as a single product

-

Desire for a Chief “Get-Stuff Done Officer” vs a loose constellation of advisors, vendors, suppliers, and internal staff

-

Interest in quality dealflow

Exploring enduring issues affords families, their staff, and their advisors the chance to return to founding principles, as opposed to attempting to gauge the pulse of trends.

What is the family office doing to improve the quality of life for the family?

Exploring family office trends

While sometimes challenging to quantify, there are certainly family office trends we can examine.

Let’s explore one of these trends: an increased familiarity with the term "family office."

Awareness of the term: family office

Anyone who has spent time in the family office space can attest to the growing number of family office-oriented organizations, the media coverage appetite, and the increasing number of new specialized “family office” roles within various vendor organizations. It seems that "family office" is everywhere.

Let’s examine some data to back up our intuition that the term family office has become more popular over the years.

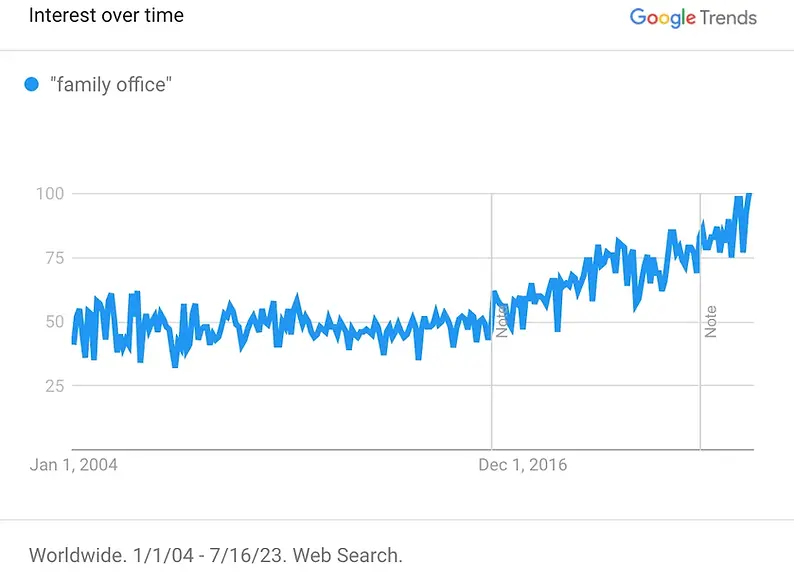

One approach is to examine Google Trends data. Google Trends information looks at what is trending across Google Search, Google News, and YouTube. Google Trends data does have potential pitfalls, but it provides some interesting insights when we look at the term “family office” over time.

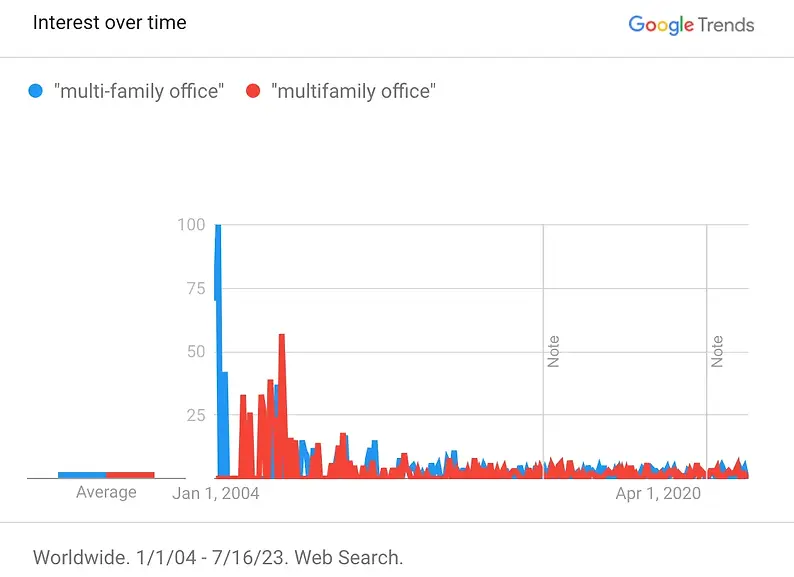

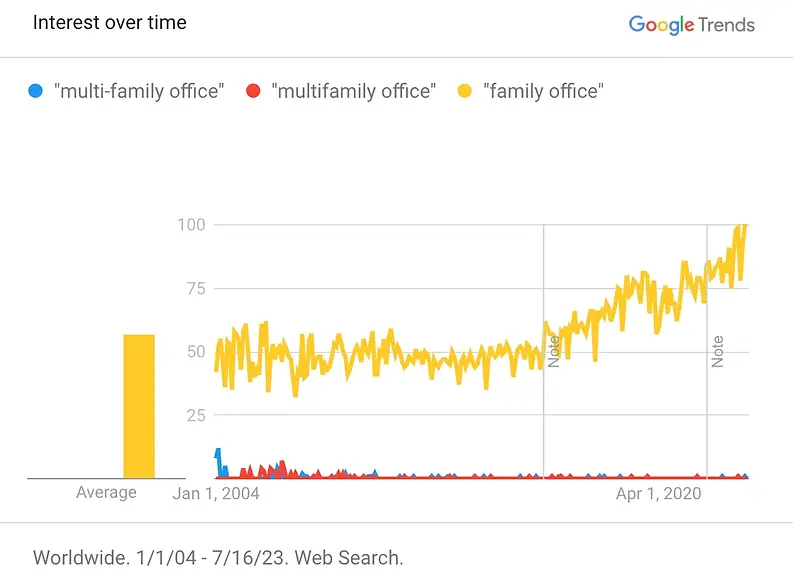

The charts below show interest in “family office” increasing from 2004 to today, both on a global and U.S. basis. The data around “multifamily office” (MFO) is more noisy, making it harder to parse out an increase in interest in this area.

Figure 1: U.S. interest in the term “family office”

Data source: Google Trends (https://www.google.com/trends).

Figure 2: Worldwide interest in the term “family office”

Data source: Google Trends (https://www.google.com/trends).

Figure 3: Worldwide interest in multi-family offices

Data source: Google Trends (https://www.google.com/trends).

Figure 4: Worldwide interest in multi-family office vs “family office”

Data source: Google Trends (https://www.google.com/trends).

Final thoughts

All of this is not to imply that there is no value in discussing family office trends.

While it can be easy to confuse trends with top-of-mind, examining tendencies can be a helpful exercise for families. It can help distinguish between fleeting fads and enduring issues crucial to the success of a family office. It can identify areas to investigate, such as the growing awareness of and interest in SFO and MFO employment opportunities. It can help families find their bearings, when they execute on their strategies.

What trends or persistent issues do you observe in family offices?